🎉 CapConnect+ is thrilled to celebrate a significant milestone, surpassing $5 billion of CP transacted on our platform (YTD - April 24, 2025) 🥳

🎉 CapConnect+ is thrilled to celebrate a significant milestone, surpassing $5 billion of CP transacted on our platform (YTD - April 24, 2025) 🥳

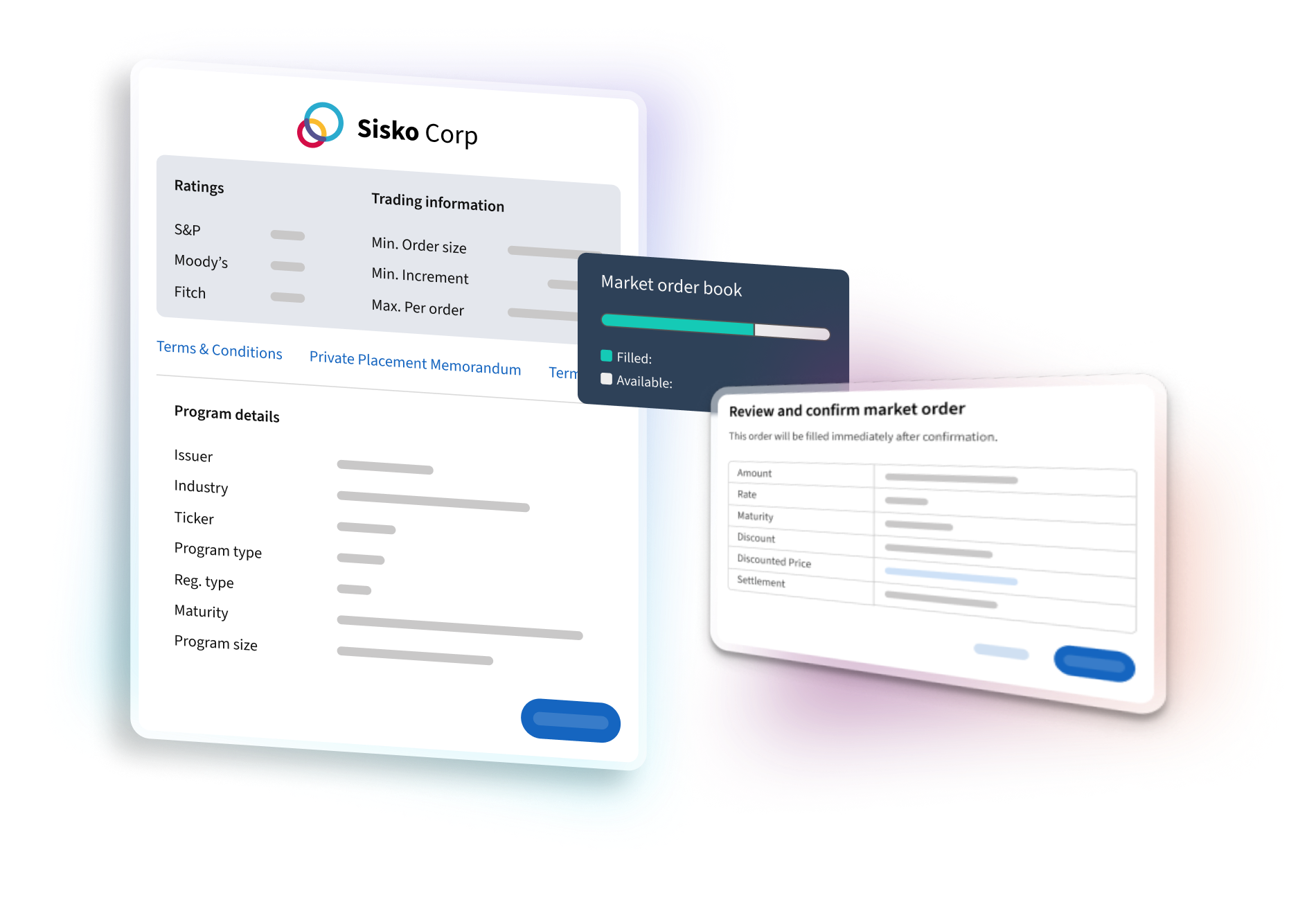

The all new CapConnect+ Digital platform

dramatically simplifies fixed income issuing and investing

CapConnect+ ... solves a pain point on the issuance side... — read more

Joseph Neu

Founder and CEO,

NeuGroup

Joseph Neu

Founder and CEO,

NeuGroup

Issuing direct to investors achieves a lower cost of funding that averages 2 bps for overnight CP and 6 bps for 30-day CP — learn more

The new CapConnect+ Digital Issuer platform is designed

to dramatically simplify your deal day.

Our exclusive Pricing OptimizerTM feature leverages real time demand curve data so you can optimize your amount and rate to achieve a lower cost of funding.

With visibility into the actual investors who buy your corporate paper, the platform reveals new reverse inquiry opportunities that help align your cash flow with your largest CP and Bond investors.

Good news for Fixed Income investors looking for alpha and transparency.

We developed the CapConnect+ Digital platform to allow you to purchase Commercial Paper directly from top issuers, giving you the chance to enhance your yields on primary CP investments.

The new CapConnect+ commercial paper platform is simple, fast and efficient. You can choose the exact maturity date to match your investment timing objectives and dramatically simplify your operations.

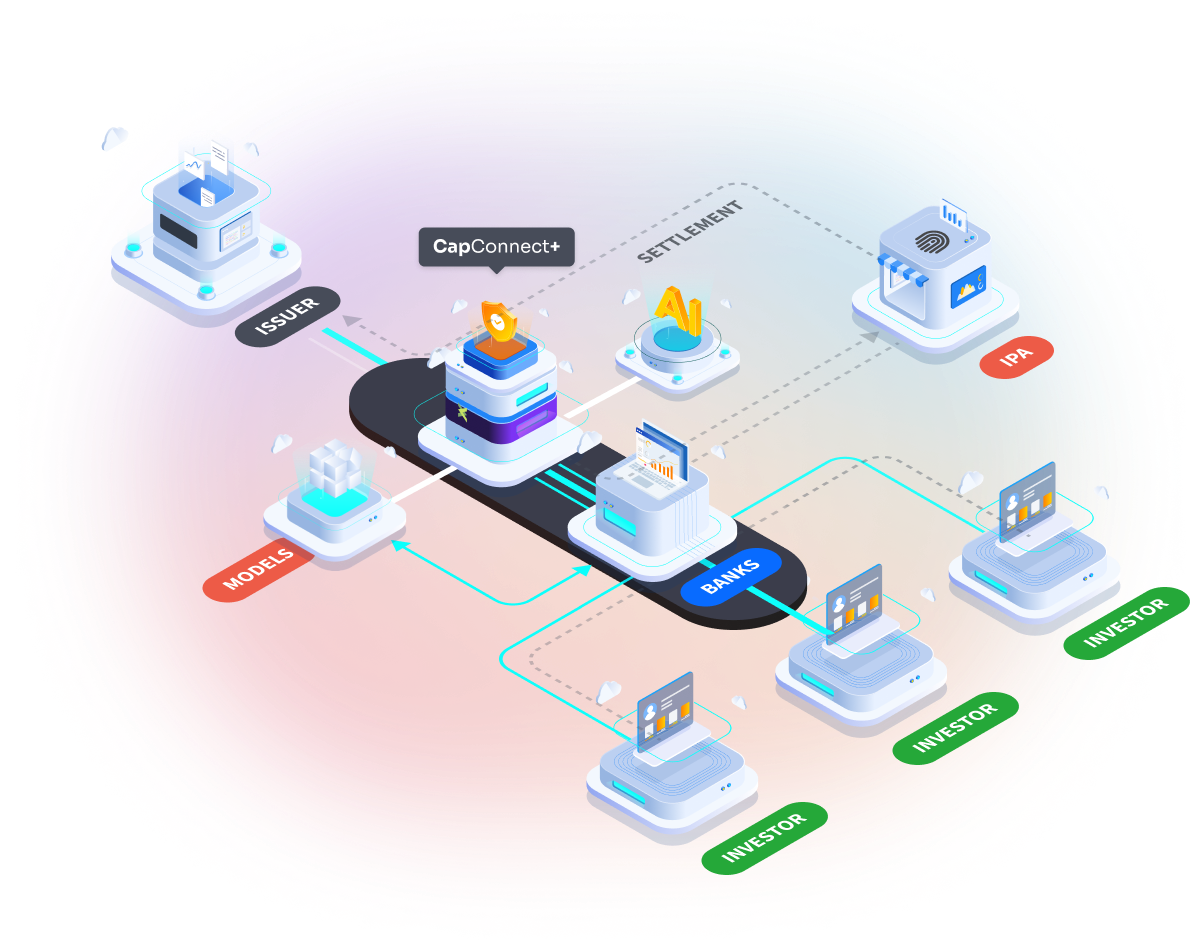

Importantly, there will be no changes to the current clearing and settlement process, so onboarding is seamless.

Investors earn higher yields (~ 2 basis points) from direct issuance, capturing savings from avoiding intermediation costs — read the full report

Current on-boarded investors include Money Market Funds, State & Pension Plans, Insurance, and Corporate Treasury, with an aggregate AUM Over

Streamline Investor Relations and Grow Your Base

Boost Investor Relations & Profitability with Automation

Our low-touch investor management solution streamlines communication with both new and existing investors, freeing up your team to focus on securing those critical high-dollar deals. This scalable system allows you to effortlessly grow your investor base without sacrificing valuable time and resources.

Data driven insights and analytics

Get a consolidated view of investment opportunities, track investments and maturity calendar on a centralized platform, and access fixed income data and analytics warehouse.

CapConnect+ employs top-tier encryption, strict access controls, and robust cybersecurity measures for a secure platform. Our industry-leading security protocols and compliance standards ensure trusted issuance workflows and peace of mind for all users.

![]()

![]()

![]()

![]()

![]()

![]()

Our digital dealer platform modernizes primary market debt issuance by connecting issuers, dealers, and investors for lower funding costs and better rates.

Securities offered through CapConnect+ eMarkets, a member of FINRA & SIPC | Office Address: 495 Seaport Court, Suite 101, Redwood City, California 94063. Check the background of CapConnect+ eMarkets LLC on FINRA —BrokerCheck. All information contained herein is for informational purposes only and any reliance on any portion of the information shall be at your own risk. The information is not to be construed as a recommendation, an offer to buy or sell, or the solicitation of an offer to buy or sell or enter into any transaction respecting any security or financial instrument.

Any company names, product or service names, and logos featured herein apart from those belonging to CapConnect+ are trademarks belonging to their respective owners. Such trademarks are used on this website for identification purposes only. Credit ratings are included solely for informational purposes, provided by or on behalf of the issuers. The presence of a name, logo, or additional information such as credit ratings does not imply endorsement of our products/services by the trademark holders or credit rating agencies.

SUPPORT

ABOUT